Advisor to the UT Ladakh, Dr Pawan Kotwal Presides 9th UT-Level Bankers’ Committee Meeting

LEH, May 28: The Advisor to the Union Territory of Ladakh/Chairman of the Union Territory Level Bankers Committee, UT Ladakh, Dr Pawan Kotwal presided over the 9th Meeting of the Union Territory Level Bankers Committee (UTLBC) of UT Ladakh for the quarter ended December 31, 2023, and March 31, 2024, at Leh.

The Assistant General Manager, State Bank of India/Convenor UTLBC of UT Ladakh, Tsering Morup highlighted the significant achievements of banks in UT Ladakh for the quarter ending March 2024 through a PowerPoint presentation. The presentation emphasized the remarkable progress made under various banking schemes aimed at fostering economic development and financial inclusion in Ladakh.

The Banks achieved 118% by disbursing a total credit of Rs.970.95 Crore under Priority Sector advances against the Annual Credit Target of Rs.821.03 Crore. The overall achievement under Priority and Non-Priority sector advances by all banks in UT Ladakh is 148% by the year-end i.e. March 2024.

The Chairman Dr Pawan Kotwal was informed that the total deposits as of March 31, 2024, stood at Rs.9193.08 Crore as compared to Rs.8593.25 Crore as of March 31, 2023, with the deposit’s growth of 7% on a year-on-year basis. The total credit as of March 31, 2024, stood at Rs.4166.75 Crore as compared to Rs.3618.63 Crore as of March 31, 2023, with a credit growth of 15.15% on a year-on-year basis in UT Ladakh. The overall CD Ratio of UT Ladakh is 45.32% for the Year ended March 31, 2024.

Advisor Ladakh Dr Pawan Kotwal highlighted the importance of various government schemes, including the Solar Rooftop Scheme and the Atal Pension Yojana. He stressed that these schemes are essential for the financial and social well-being of the community and should be given utmost priority. He directed all the banks to come forward in sanctioning the loan under the Solar Rooftop Scheme and focused that banks should make efforts to cover all eligible beneficiaries under the Social Security Scheme universally.

The Chairman directed all the Banks to sanction loans for craftsmen under the PM Vishwakarma Scheme. He also directed the sponsoring department to visit the Training Centre of Private Agencies to check the quality of training given to the PM Vishwakarma beneficiaries. He instructed all heads of banks to ensure that their successors complete and wrap up all duties before leaving their job stations or before being transferred.

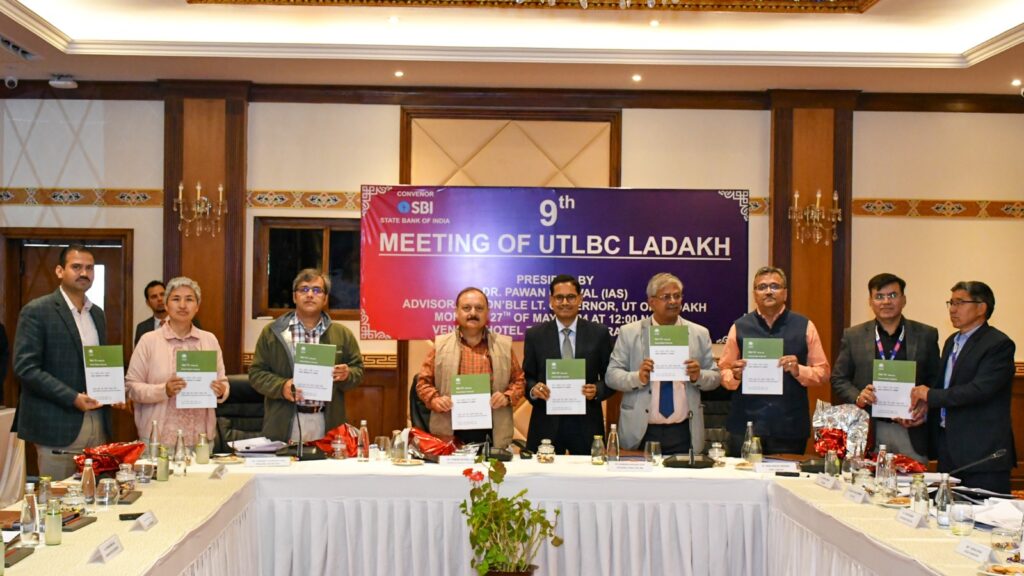

Dr Pawan Kotwal also released a focus paper outlining the strategic financial goals for the fiscal year 2024-2025. This document serves as a roadmap for achieving targeted economic growth and development in the region.

The Additional General Manager of NABARD, Sonika Rana presented a comprehensive presentation covering several key initiatives, including the promotion of solar energy, research and development, homestay initiatives, village development, skill development, and the expansion of the tourism sector.

Dr. Pawan Kotwal directed NABARD officials to prioritize the formation and implementation of quality control and standardization measures for Ladakh’s unique products. He urged the officials to focus on developing quality schemes that will ensure the authenticity and marketability of these products, thereby strengthening the local economy.

Lastly, Additional General Manager, Rajeev Kumar Chhabra concluded the meeting with a vote of thanks to all the dignitaries and other participants from line departments and banks.

The meeting was attended by the Principal Secretary, Sanjeev Khirwar; Commissioner Secretary, Padma Angmo; Administrative Secretary, Vikram Singh Malik; Under Secretary, Mohit Sharma; representative of District Magistrate, Leh; Directors of concerned departments; Regional Director (J&K & Ladakh) Reserve Bank of India, Jammu; General Manager, RBI; Chief General Manager, NABARD Jammu; General Manager, State Bank of India; and senior representatives of the member banks and financial institutions, while District Magistrate, Kargil; and Chief General Manager, SBI joined the meeting virtually.