DC Srinagar chairs District Level Bankers Review Committee Meeting

Rs. 1398.43 Cr disbursed among 37590 sanctioned cases generating self employment for 87000 youth in District Srinagar

Potential Linked Credit Plan of NABARD for ₹ 2825.0 Cr released for FY 2023-24

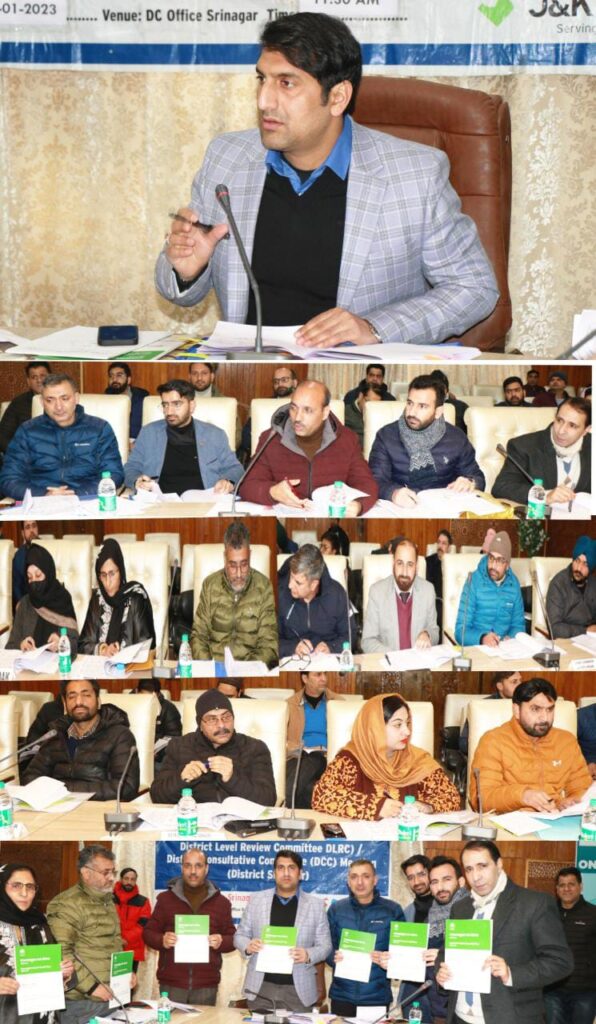

SRINAGAR, January 06:- To review the performance of the Banks and other Financial Institutions under various Government initiatives and sponsored schemes, a meeting of District Level Review Committee/District Consultative Committee (DLRC/DCC) was held today under the Chairmanship of Deputy Commissioner(DC) Srinagar, Mohammed Aijaz Asad here at Meeting Hall of the DC Office Complex.

Besides, Additional District Development Commissioner, Srinagar, Zahoor Ahmad Mir, the meeting was attended by Chief Planning Officer, Mohammad Yaseen Lone, Lead District Officer, RBI, Lead District Manager Srinagar, DDM NABARD and Officers from Employment, Handicrafts, Horticulture, Agriculture, Animal & Sheep Husbandry, Fisheries and other concerned Departments. Besides, senior Officers of J&K Bank, SBI, PNB, HDFC and other sponsoring agencies operating in Srinagar.

At the outset, the Deputy Commissioner took a sector wise performance of the Banks in implementation of different Government initiatives viz Back to Village-4.0, My Town My Pride-2.0 etc. He also reviewed the achievements of Banks in lending to priority/non priority sectors under Annual Credit Plan.

On the occasion, the DC was apprised that an amount of Rs 1398.43 crore was disbursed among 37590 sanctioned cases in Srinagar District under different self-employment schemes thereby generating self-employment opportunities for over 87000 unemployed youth of the District during last 3 quarters.

The DC was informed that as many as 1184 unemployed youth/beneficiaries were provided financial support to the tune of Rs 39.18 crore to establish their income generating units to earn livelihood under different self-employment schemes during Back to village-4 and My town My Pride-2.0 programmes.

Giving details, it was informed that under the recently organized Back to Village-4.0 programme of the Government held from October 10 to November 03, 2022, as many as 522 cases were sanctioned with disbursement of Rs 18.37 crore.

Similarly, under the My Town My Pride (MTMP-2.0) programme organized from November 28 to December 06, 2022, an amount of Rs 20.81 crore was disbursed among 516 unemployed youth of the City for establishing income generating units under different self-employment schemes.

With regard to Nationwide Intensive Awareness Campaign of RBI held in the month of November, 2022, the DC was informed that as many as 429 awareness camps were organized by different Banks operating in Srinagar District to enhance the level of financial education and awareness regarding frauds amongst the customers and complaint redressal mechanism like Internal Grievances Redress (IGR) as well as Alternative Grievance Redress (AGR) mechanism of RBI.

While reviewing the Bank wise movement of CD Ratio in the District, the DC was informed that total Deposits of the District Srinagar stood at Rs 32388.42 Crore and Advance at Rs 21979.58 Crore constitute 67.9 percent CD Ratio in quarter ended in September, 2022.

Besides, Banks operating in Srinagar have disbursed Rs. 3147.47 crore among 70111 beneficiaries under Annual Credit Plan for financial year 2022-2023, which Includes Rs 835.51 Crore under priority sector and Rs 2311.95 Crore in non-priority sector.

The DC was further apprised that under Prime Ministers Mudra Yojna(PMMY) Scheme Banks operating in Srinagar have disbursed Rs 389.72 crore among 12231 beneficiaries of the District as of November 30, 2022.

Under the Pradhan Mantri Employment Generation programme (PMEGP), a total 1583 cases were sanctioned and an amount of Rs 82.73 crore were sanctioned among beneficiaries.

Similarly, giving overview of Credit Disbursement through different schemes, the Lead District Bank Manager, Abdul Majid apprised the chair that under Pradhan Mantri SVANIDHI schemes Rs 7.07 crore were disbursed among 5953 registered Street Vendors in the District under which Urban Street Vendors are eligible to avail a loan of Rs 10000 with tenure of one year with interest subsidy of 7 percent for handholding of youth.

With regard to implementation of Nation Urban Livelihood Mission (NULM), a total 212 cases were sanctioned with disbursement of Rs. 3.45 crore among the beneficiaries in the District.

While reviewing performance under Mission Youth schemes, for providing self-employment, the DC was informed that under the MUMKIN scheme, a total 245 cases have been sanctioned so far involving an amount of Rs 17.36 crore.

Similarly, under TEJASWINI scheme 97 cases have been sanctioned with an Amount of Rs 4.79 crore

The Chair was also informed that as many as 116860 beneficiaries have been enrolled under different Social Security Schemes. Under Atal Pension Yojna 7025 beneficiaries have been registered, Similarly under PM Joyti Jewan Bhima Yojana 29071 beneficiaries and 80764 beneficiaries were enrolled under PM Suraksha Bhima Yojna in Srinagar District. It was also given out that over 70 Financial Literacy Camps were organized by FLC Centre Srinagar including 20 Digital Literacy Camps.

Speaking on the occasion, the DC stressed on all the line Departments and Banks operating in the District to improve the IEC activities to educate and sensitize the people about financial literacy about different banking products and Government sponsored schemes particularly in rural and urban belts of Srinagar so that they can avail the benefits of such schemes by setting up income generating units. He also stressed on enhancement in the overall credit flow of banks in the District which is essential for financial impetus and improving income levels and thereby help in raising standard of living of people.

While appreciating the Lead District Manager, Abdul Majeed Bhat and Jammu and Kashmir Bank and for active participation in implementation of self-employment initiatives of Government particularly during B2V4 and MTMP-2.0, the DC urged them to continue the tempo of the working system of the Bank and provide better services to the public.

The DC urged upon the Banks and other financial institutions operating in Srinagar to contribute under Corporate Social Responsibility(CSR) in different ways for overall development of the society

He also stressed on enhancement in the overall credit flow of banks in the District which is essential for financial impetus and improving income levels and thereby help in raising standard of living of people.

The DC also asked Banks and all line Departments to encourage novice entrepreneurs under economic activities to inspire them for setting up viable income generating units in the district. He called upon officers to work in unison with added vigour and zeal and set realistic targets so that desired results are achieved within the set timeline.

He also advised the representatives of financial institutions and sponsoring agencies to come forward and help the unemployed youth of the capital for eradicating poverty, unemployment and reaching out to the poorest of the poor.

On the occasion, the Deputy Commissioner also launched Rs 2825 crore Potential Linked Plan (PLP) 2023-24 of National Bank for Agriculture and Rural Development (NABARD) for Srinagar District which shall act as a guiding document to the Bankers for optimal utilization of Credit for development.