J&K State Taxes Department inks MoU with ICAI

The MoU for knowledge sharing, capacity building will establish a more efficient, transparent and fair indirect tax regime: LG Sinha

LG lauds the honest taxpayers for their contribution in development of J&K; appreciates State Taxes Department for simplifying tax processes

J&K’s GST revenue growth has been much higher than the national average: LG

We have reasons to be confident about future prospects due to reforms we carried out in the last few years to accelerate economic growth with social equality: LG

New policies, greater transparency in governance and crackdown on cronyism have enabled the enterprises, Industries and new-age businesses to grow: LG Sinha

We have placed great emphasis to make the economy more competitive, increase the tax base, compliance and strengthen trust between citizens and the Government: LG

State Taxes Department and citizens should play a constructive role in pushing forward to industrialisation and making J&K as one of the engines of Viksit Bharat

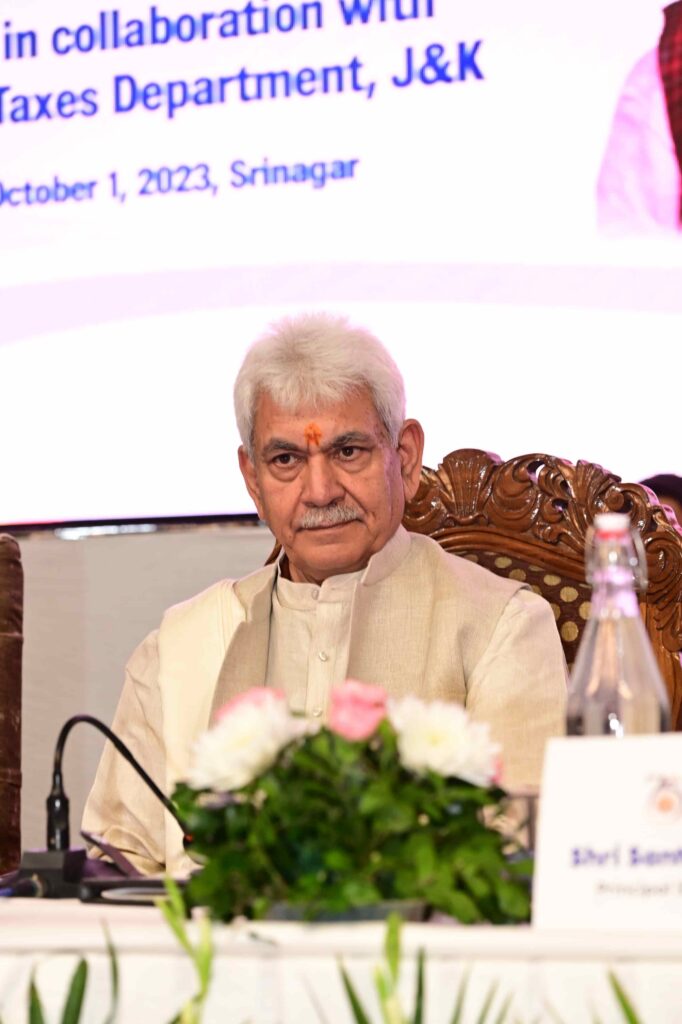

SRINAGAR, OCTOBER 01: J&K State Taxes Department today inked a Memorandum of Understanding (MoU) with Institute of Chartered Accountants of India (ICAI) for knowledge sharing and capacity building of the officers of State Taxes Department, in presence of Lieutenant Governor Shri Manoj Sinha.

In his address, the Lt Governor complimented the high standards of professionalism shown by the J&K State Taxes Department and ICAI.

He said the MoU signed today marked the beginning of a new partnership between ICAI and Jammu Kashmir.

The support and assistance of the ICAI to the State Taxes Department in future policy making and various other aspects related to taxation will strengthen the ongoing reforms in ease of doing business and economy, he added.

At the inaugural session of the Capacity building programme on GST, the Lt Governor lauded the honest taxpayers for their contribution in development of J&K and shared the efforts of the government for creating a favorable environment for economy and business.

The GST revenue growth of Jammu Kashmir has been much higher than the national average and we have reasons to be confident about future prospects due to reforms we carried out in the last few years to accelerate economic growth with social equality, the Lt Governor said.

“New policies, greater transparency in governance and crackdown on cronyism have enabled enterprises, Industries and new-age businesses to grow. We have placed great emphasis to make the economy more competitive, increase the tax base, compliance and strengthen trust between citizens and the Government,” he said.

The Lt Governor appreciated the State Taxes Department for making tax-paying process seamless and friendlier in every district and spreading awareness on tax regime.

He urged the department and the citizens of the UT to play a constructive role in pushing forward to industrialisation and making J&K one of the engines of Viksit Bharat.

The Lt Governor also assured all the necessary support by the administration to the ICAI for establishing their Centre of Excellence in the UT.

The Lt Governor released the revised edition of GST Acts and Rules – Bare Law and felicitated the consumers under ‘Mera Bill Mera Adhikar’ campaign.

Dr. Arun Kumar Mehta, Chief Secretary; Sh Santosh D Vaidya, Principal Secretary, Finance; Dr Rashmi Singh, Commissioner State Taxes Department; Sh Ranjeet Kumar Agarwal, Vice President ICAI; Sh Sushil Kumar Goyal, Chairman, GST & Indirect Taxes Committee; Sh Umesh Sharma, Vice Chairman, GST & Indirect Taxes Committee; senior Officers; members of ICAI; representatives of Trade & Industry Associations and heads of educational institutions were present.