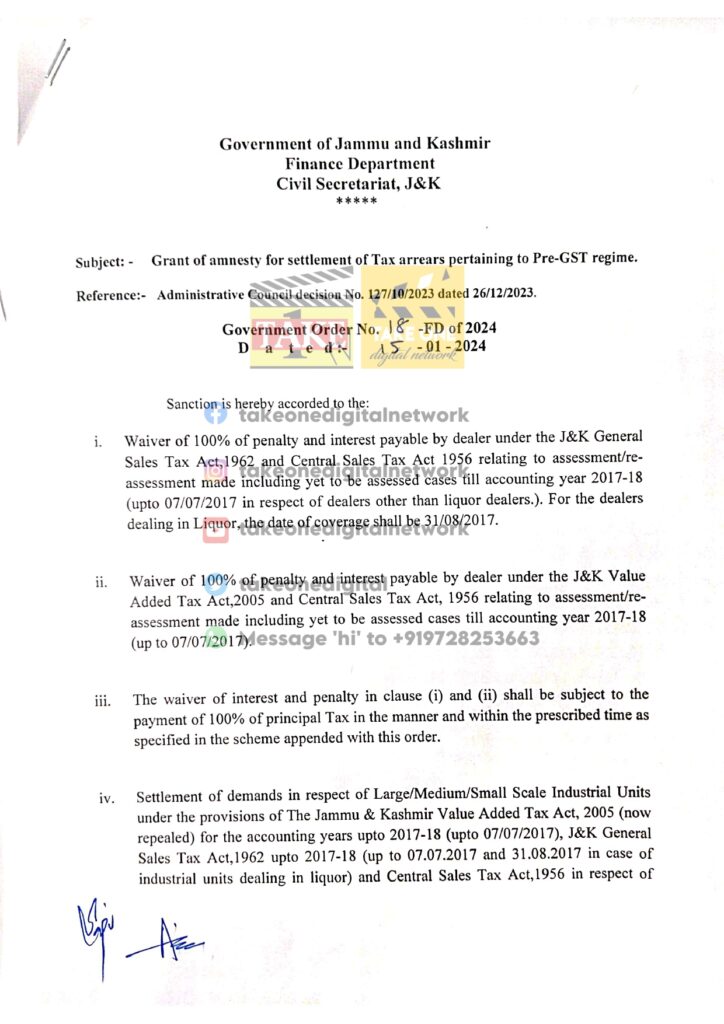

Major relief for taxpayers as J&K Govt announces amnesty for settlement of pre-GST tax liabilities

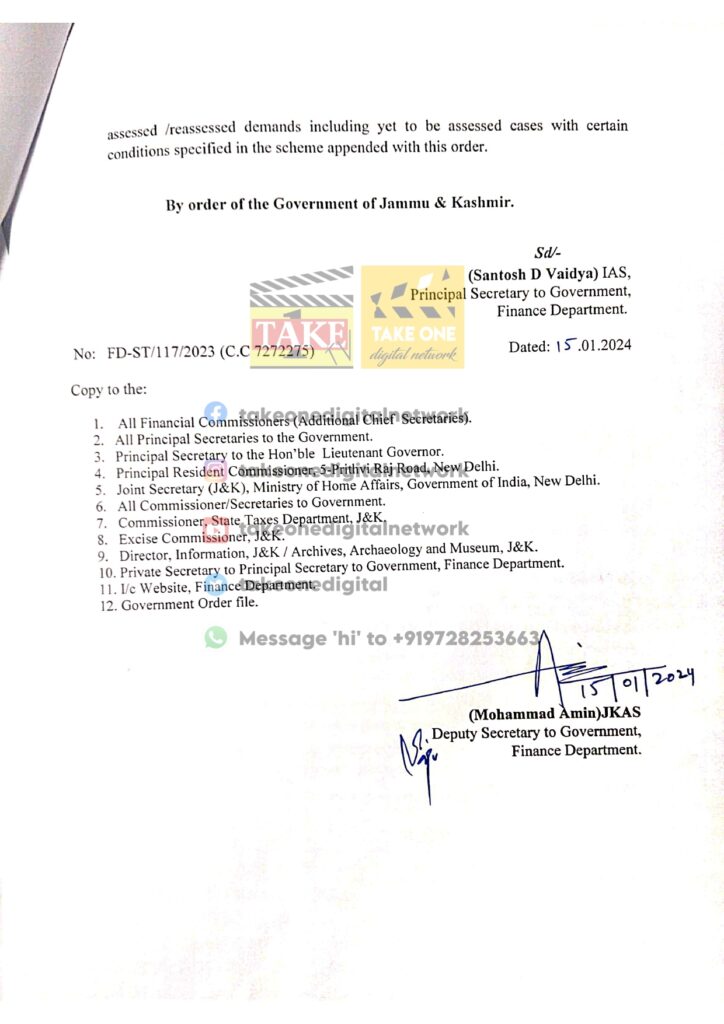

In a significant move to boost economic growth and provide relief to taxpayers, the Jammu and Kashmir government has announced a comprehensive tax amnesty scheme for settlement of outstanding arrears pertaining to the pre-GST era. The scheme, which came into effect on January 15, 2024, offers a waiver of 100% of penalty and interest on tax dues under the J&K General Sales Tax Act, 1962, the J&K Value Added Tax Act, 2005, and the Central Sales Tax Act, 1956.